does florida have state capital gains tax

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. Taxes capital gains as income and the rate reaches 575.

State Taxation Of Capital Gains The Folly Of Tax Cuts Case For Proactive Reforms Itep

The rate reaches 693.

. There is currently no Florida income tax for individuals and therefore no Florida capital gains tax for individuals. However if you are in the 396 income tax bracket you will pay a 20 capital gains rate on your long-term capital gains. Florida Dividends and Interest Tax.

Some tax-free states like New Hampshire have no income tax on job. Florida does not have state or local capital gains taxes. This amount increases to 500000 if youre married.

The capital gains tax is a tax on money earned from investments rather. Does Florida Have Capital Gains Tax On Stocks. Individuals and families must pay the following capital gains taxes.

As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. Since 1997 up to 250000 in capital gains 500000 for a married couple on. Therefore the top federal tax rate on long-term capital gains is 238.

In a state whose tax is stated as a percentage of the federal tax. You dont have to pay capital gains tax until you sell your investment. Residents living in the state of Florida though there are those who can see a long-term capital gains tax rate as.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency. Just like income tax youll pay a tiered tax rate on your capital gains.

The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. Capital Gains Tax Exemption When selling your house in Florida you can exclude a high portion of your profits given specific conditions are met.

Generally speaking capital gains taxes are around 15 percent for us. Make sure you account for the way. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

Florida does not have an income tax on dividends or interest. Not All Profits Are Taxable. No there is no Florida capital gains tax.

The two year residency test need not be. The State of Florida does not have an income tax for individuals and. Florida Department of Revenue.

The state of Florida does not have a capital gains. Does Florida Have Capital Gains Tax. Generally speaking capital gains taxes are around 15 percent for US.

Florida does not have state or local capital gains taxes. Ncome up to 40400. You have lived in the home.

State and local taxes often apply to capital gains. Idaho axes capital gains as income. The tax rate youll pay depends on how long youve owned the property.

But if you live in Florida youll be responsible for paying federal capital gains tax when you sell your house. Taxes capital gains as income. For example a single person with a total short-term capital gain of 15000 would pay 10 of.

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

State Taxes On Capital Gains Center On Budget And Policy Priorities

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Capital Gains Tax Rates For 2022 Vs 2023 Kiplinger

Capital Gains Tax In The United States Wikipedia

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Washington Thecentersquare Com

Capital Gains Tax Calculator Estimate What You Ll Owe

Why So Many Vcs Are Moving To Austin And Miami Saastr

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

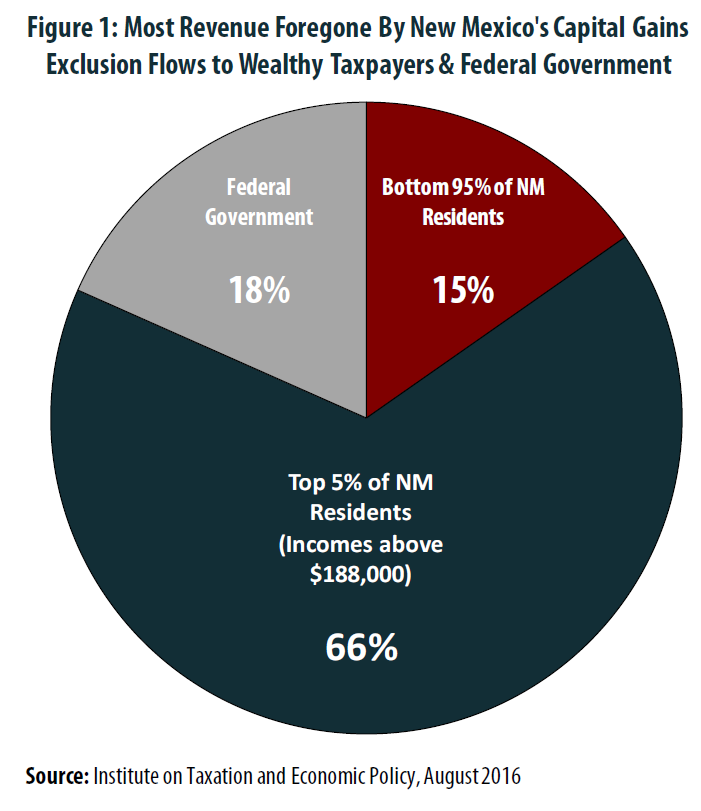

The Folly Of State Capital Gains Tax Cuts Itep

How To Calculate Capital Gains Tax On Real Estate Investment Property

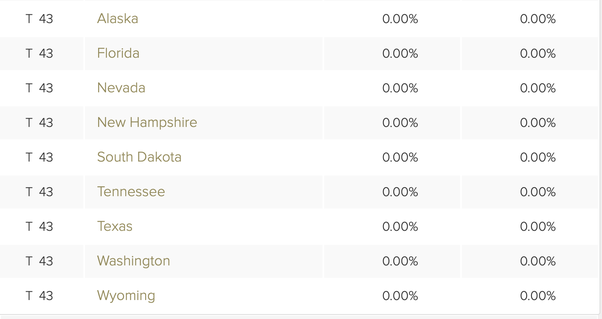

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Tax Archives Skloff Financial Group

How To Know If You Have To Pay Capital Gains Tax Experian

Florida Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

2022 Income Tax Brackets And The New Ideal Income